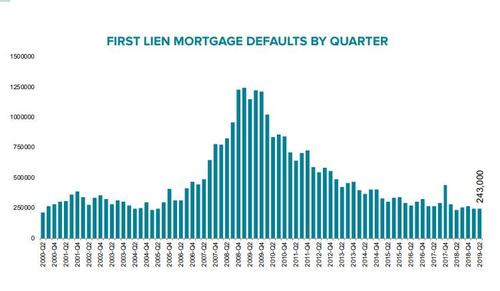

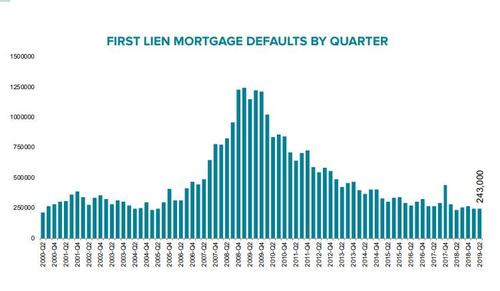

To provide some insights on these issues, Congress asked GAO to analyze (1) the scope and magnitude of recent default and foreclosure trends, and how these trends compare with historical values, and (2) developments in economic conditions and the primary and secondary mortgage markets associated with these trends.

These developments have raised questions about the extent and causes of problems in the mortgage market. Additionally, recent increases in defaults and foreclosures have contributed to concern and increased volatility in certain U.S. Defaults and foreclosures on home mortgages can impose significant costs on borrowers, lenders, mortgage investors, and neighborhoods. However, as of the latest quarterly data available, June 2007, more than 1 million mortgages were in default or foreclosure, an increase of 50 percent compared with June 2005. Provisional dates will be confirmed or revised no later than a week before.Substantial growth in the mortgage market in recent years has helped many Americans become homeowners. economy, so it is important to step back and understand what caused them. The next edition will be published here on 12 September 2023. The financial crisis and recession of 20 were serious blows to the U.S. See our previous editions of the statistics on mortgage lending. More than three quarters of a million UK households are at risk of defaulting on their mortgage payments in the next two years, the country’s top financial regulator has warned.

proportion of mortgage loans above Bank Rate. The lowest rates are in the Mountain states of Colorado, Utah, and Idaho, with each reporting rates.

Southern states like Mississippi, Louisiana, and Florida also report high mortgage delinquency rates.

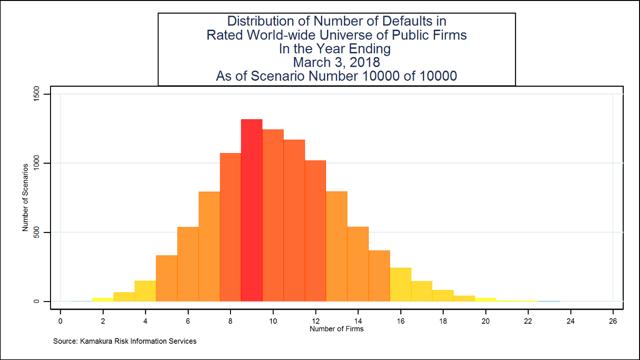

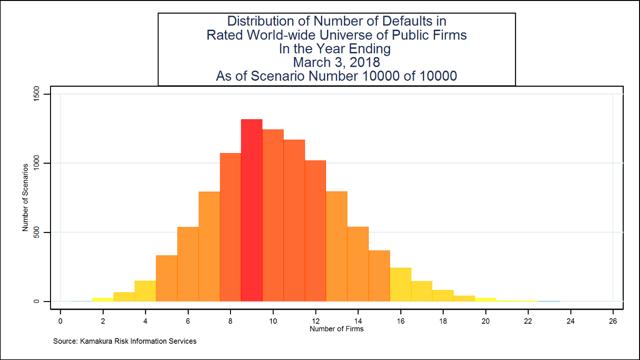

total gross advances by loan-to-value, income multiples and purpose of loan New York shows the highest percentage at 1.90 percent, followed by Connecticut and Delaware at 1.77 percent and 1.73 percent, respectively. the outstanding value of all residential loans. Researchers at the US central bank just published a paper warning that a historic surge in the percentage of distressed American companies could worsen the fallout from the. The FCA and the Prudential Regulatory Authority (PRA) both have responsibility for the regulation of mortgage lenders and administrators so this data publication is joint. 13 hours ago &0183 &32 Jacquelyn Martin/AP. Since the beginning of 2007, around 340 regulated mortgage lenders and administrators have been required to submit a Mortgage Lending and Administration Return (MLAR) each quarter, providing data on their mortgage lending activities. This was also the lowest observed since 2020 Q2. The value of new mortgage commitments (lending agreed to be advanced in the coming months) in 2023 Q1 was 16.1% less than the previous quarter and 40.7% less than a year earlier, at £48.9 billion. had reached 8.2 percent, the highest since 2011 and almost double the 4.5 percent of a year earlier. This was the lowest observed since 2020 Q2. According to the Mortgage Bankers Association, as of June 30, mortgage delinquency in the U.S. The value of gross mortgage advances in 2023 Q1 was £58.8 billion, which was £22.9 billion lower than the previous quarter, and 23.6% lower than in 2022 Q1. mortgage industry is one of the largest in the world, and the infamous subprime mortgage crisis of.  The outstanding value of all residential mortgage loans was £1,675.4 billion at the end of 2023 Q1, 2.7% higher than a year earlier, but a decrease on the previous quarter for the first time since 2017 Q2. United States Mortgage debt is one of the main sources of debt held by Americans. And mortgagees in possession people whose homes are repossessed. Banks are insured U.S.-chartered commercial banks. As of March, there was about 10.5 billion in non-performing loans held by owner occupiers, up from 9.6 billion in March 2019. MLAR statistics: detailed tables (Excel)įor any technical queries on the tables contact MLAR Statistics.Īn explanatory note detailing the relationship between this data and other mortgage statistics published by the Bank of England is available on their website. Charge-offs, which are the value of loans removed from the books and charged against loss reserves, are measured net of recoveries as a percentage of average loans and annualized. MLAR statistics: summary tables (Excel). The commentary includes technical information on the MLAR as well as analysis of the findings.

The outstanding value of all residential mortgage loans was £1,675.4 billion at the end of 2023 Q1, 2.7% higher than a year earlier, but a decrease on the previous quarter for the first time since 2017 Q2. United States Mortgage debt is one of the main sources of debt held by Americans. And mortgagees in possession people whose homes are repossessed. Banks are insured U.S.-chartered commercial banks. As of March, there was about 10.5 billion in non-performing loans held by owner occupiers, up from 9.6 billion in March 2019. MLAR statistics: detailed tables (Excel)įor any technical queries on the tables contact MLAR Statistics.Īn explanatory note detailing the relationship between this data and other mortgage statistics published by the Bank of England is available on their website. Charge-offs, which are the value of loans removed from the books and charged against loss reserves, are measured net of recoveries as a percentage of average loans and annualized. MLAR statistics: summary tables (Excel). The commentary includes technical information on the MLAR as well as analysis of the findings.

#Number of mortgage defaults by year full#

The latest commentary and full statistical tables are available below. Statistics on mortgage lending: Q1 2023 edition foreclosure filings spiked by more than 81 in 2008, a record, according to a report released Thursday, and theyre up 225 compared with 2006.

0 kommentar(er)

0 kommentar(er)